From 6th Graders to CEOs

Do you remember when you first learned what a budget is? It probably wasn’t in school and it might not have been until you were presented with a situation where you needed to know how to manage one. Students are often unprepared to deal with the finances and economic realities they face as they enter adulthood. Even adults are often unaware of how to best manage their finances.

Greg Crowe wants to change that. As a senior vice president at Wells Fargo and a veteran banker, Greg knew it was important to pass his financial knowledge onto his sons as they were growing up. “I knew I wanted to share this with more kids though. We’re faced with learning about financial planning when we get into the real-world. Young people can encounter difficulties if they don’t learn it at an early age. It’s not rocket science; it’s a lack of knowledge,” said Crowe.

Do you remember when you first learned what a budget is? It probably wasn’t in school and it might not have been until you were presented with a situation where you needed to know how to manage one. Students are often unprepared to deal with the finances and economic realities they face as they enter adulthood. Even adults are often unaware of how to best manage their finances.

Greg Crowe wants to change that. As a senior vice president at Wells Fargo and a veteran banker, Greg knew it was important to pass his financial knowledge onto his sons as they were growing up. “I knew I wanted to share this with more kids though. We’re faced with learning about financial planning when we get into the real-world. Young people can encounter difficulties if they don’t learn it at an early age. It’s not rocket science; it’s a lack of knowledge,” said Crowe.

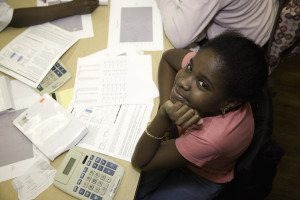

This spring Greg is teaching the “Your Financial Future” apprenticeship to a class of sixth graders at Patrick Henry Middle School in Houston, TX. Students are learning the ins and outs of balancing a budget and are given real-world challenges each week.

“I wanted an authentic scenario as our basis for teaching the financial literacy curriculum,” said Greg. “We began with each student representing a four-member household. They were given a job, weekly salary, house, car, and set expenses. We outlined a one month cash flow, noting what funds were fixed and what was discretionary.”

He adds, “They also had options such as choosing a fancy car or a premium TV package. We then encouraged them to think of the future and see how much they could save if they planned ahead. The students quickly began to understand the purpose of a budget.”

By providing the students with relatable scenarios, they were already gaining the concept of planning and budgeting after the first few classes. They also apply their math skills during Greg’s weekly challenges. They have had to figure out gas allowances based on their weekly mileage, decide whether they could afford a trip to Disney World and plan for a weekly grocery shopping trip based on their needs and wants.

“My goal in teaching this course was go beyond teaching the students financial planning, but getting them to really think about spending and appreciating money rather than focusing on their desires like a new pair of shoes,” said Greg. “The students have a short attention span though so I try to use different tactics to emphasize the same point from a new angle.”

Half way through the semester, he transitioned the class from focusing on a family’s budget to a company’s budget. “In this scenario, each student is a CEO. Everyone has the same hypothetical company, which in our case is an oil company. We gave them a cash flow for the first three months of the year and projections of what’s to come in the next quarter and what’s happening in the industry.”

Greg took what was presented in their personal budget management and is creating new challenges as they further grasp the concepts. “We told the students that their cash flow is dwindling and they will be expecting a call from their banker soon concerning the repayment of a loan. The students have to think of ways to convince the banker that they will be able to repay the loan. They roleplay with one student playing the role of CEO and one as the banker in this challenge. They sit in the room negotiating, the banker gives objections, and the CEO has to confidently present three ideas to ultimately save the company,” said Greg.

The students are not only grasping essential financial concepts to apply to their personal lives and a business environment, but they are also practicing their math skills and learning negotiation tactics. The students will enter seventh grade already transformed into financial advisors, ready to help a family or company balance their finances utilizing their budgeting skills learned in the class. For their final challenge the students will advise their families, teachers, and peers on budgeting and planning for the future during their WOW! event next month.